Business Verification

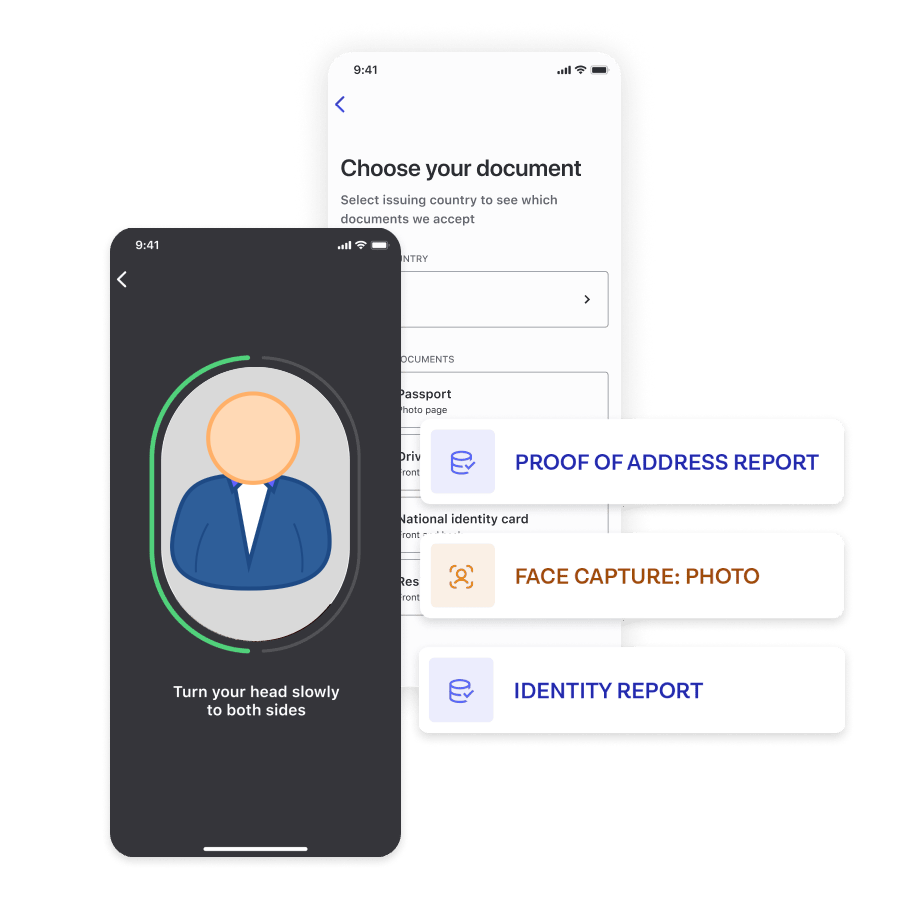

Streamline your business verification processes with Infopass.

We will help you create a comprehensive and efficient process used to identify

and verify the identity of a business or organisation. Know Your Business checks ensure a

company understands the corporate structure of a business client.

Business Verification used for -

- Business Verification

- Documents Check

- Beneficiaries Check

Trusted by Companies

A Comprehensive Approach to Business Verification

Business Verification Flow

1

We help you create a custom verification form

2

Applicants fill out the form or information is pre-filled from

business registries

3

Company representatives are automatically verified

4

You make the final decision on contracts

5

To stay compliant, you can choose to set up continuous monitoring

Fight Business Identity Fraud From the Start

Business identity theft commonly stems from fraud

presentation at verification. Fraudsters acquire a company’s data and falsely represent it to

apply for credit, sell illegitimate wares or commit further fraud on a platform under the guise

of a legitimate business.

Confirm the Submitter Works for the Business

Infopass helps organizations combat business identity

fraud at verification. A simple, low-friction check verifies the person’s employment at the

company. That natural extension of the business verification process can mitigate fraud and

provide an additional risk signal for final decisioning.

One Platform to Streamline Your Entire KYB Process

FAQ

Know your business verification is the process financial

institutions and other companies must go through to confirm the legitimacy of any

corporate clients. It allows businesses to avoid money laundering attempts as well as

recognise the ultimate beneficial owner of any client. An efficient KYB verification

process not only protects that company but does so in a timely manner.

KYB often requires considerable time and effort. Automated KYB reduces

costly manual checks, helps ensure accuracy with in-depth reporting and can improve risk

evaluation to enhance fraud protection.

Infopass’s identity verification takes less than 60 seconds on

average. However, this all depends on the process and system your IDV provider uses.

Where automated processes can usually be done in a few minutes or hours, manual

processes might take a few days or even weeks.

Business verification services are tools that allow companies to

learn about another company before entering into a business relationship with them. This

is required for honest business practices, money laundering prevention, and compliance

with other regulations.